Introduction to Financial Independence

Financial independence is a term that resonates deeply in today’s economic landscape, representing the ability to make choices about one’s life without being constrained by financial pressures. It goes beyond mere wealth accumulation; it encompasses a lifestyle that prioritizes personal freedom and the pursuit of one’s passions, unencumbered by financial obligations. At its core, financial independence involves having sufficient income, savings, and investments to cover one’s living expenses for the foreseeable future.

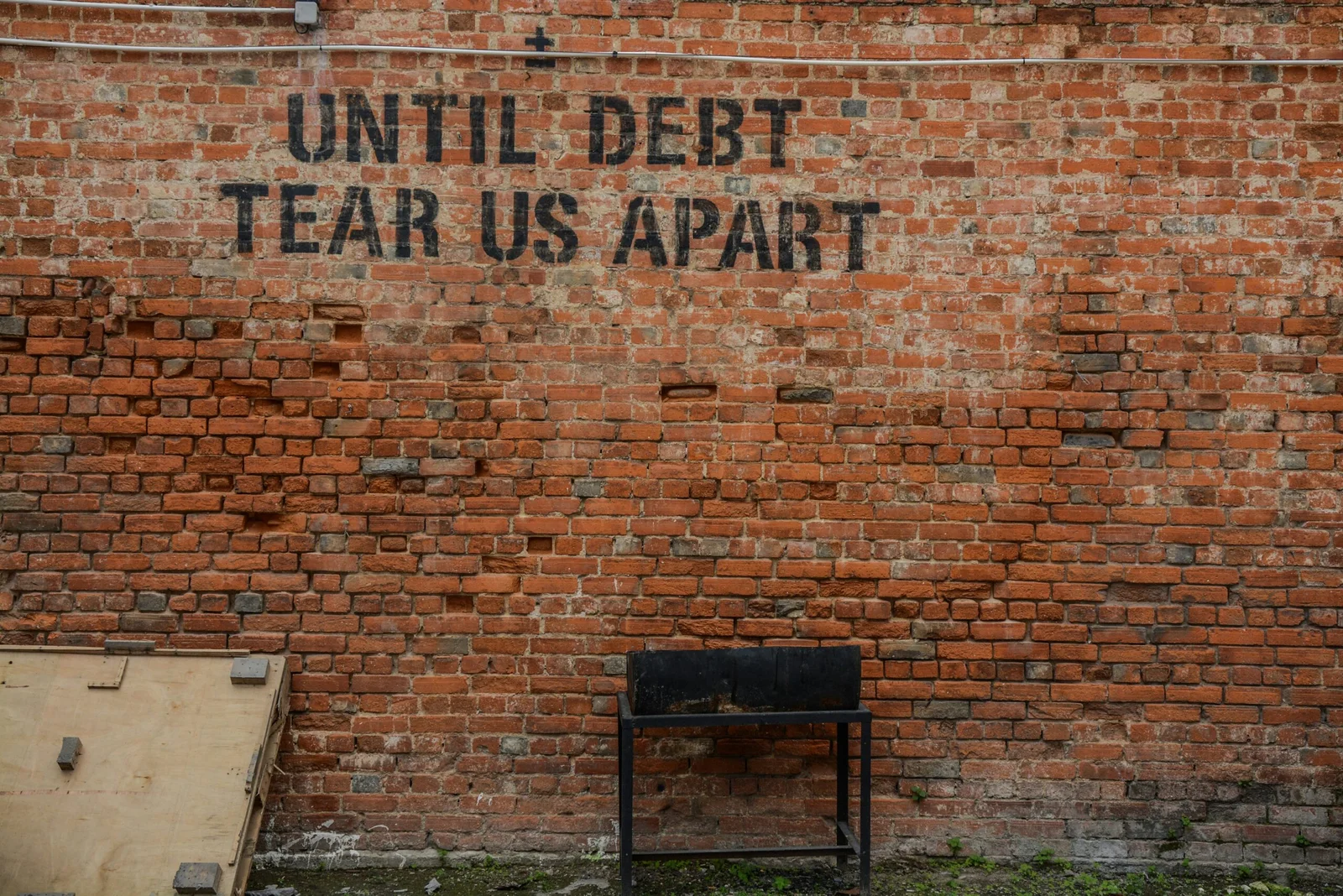

In contemporary society, attaining financial independence has become an aspiration for many individuals. The pursuit of this goal often involves a multi-faceted approach, including the elimination of debt, establishment of an emergency fund, investment in retirement accounts, and generation of passive income streams. These strategies not only prepare individuals for unexpected financial fluctuations but also lay the groundwork for long-term stability and growth.

Moreover, financial independence becomes increasingly significant against the backdrop of volatile economic conditions and fluctuating job markets. The importance of having a financial safety net has been amplified in recent years, as individuals strive to secure their financial futures amid uncertainties. A common goal associated with achieving financial independence is the ability to retire early. Such a milestone allows individuals to dedicate time to interests and endeavors that bring them fulfillment, rather than being tethered to a job solely for financial reasons. Another objective often linked to financial independence includes reaching savings milestones, which provide a sense of security and peace of mind.

Ultimately, embracing the mindset that prioritizes financial independence sets the stage for a more intentional approach to personal finances. By focusing on timely action and proactive management of resources, individuals can cultivate a pathway to not only financial stability but also overall life satisfaction.

The Power of Compound Interest

Compound interest, often referred to as “interest on interest,” is a fundamental concept that plays a crucial role in wealth accumulation. It is the process where the earnings on an investment, both capital and previous interest, generate additional earnings over time. The earlier one begins saving or investing, the more pronounced the effects of compound interest become, considerably enhancing financial growth.

To understand how compound interest works, consider an example where an individual invests $1,000 at an annual interest rate of 5%. After the first year, the investment will grow to $1,050. In the second year, instead of earning interest solely on the initial $1,000, the interest is calculated on the new total of $1,050. This process continues, resulting in a compounding effect that can transform modest sums into substantial amounts over the years. If the same investment continues for 30 years without additional contributions, the ending balance would reflect an impressive total of approximately $4,321, illustrating the exponential growth afforded by time and patience.

Moreover, the benefits of compound interest become increasingly magnified as one increases their investment or saving duration. For instance, starting to invest at age 25 versus waiting until age 35 can create a significant disparity in wealth accumulation due to the additional decade of compounding. Utilizing online calculators can help visualize these differences and encourage individuals to take timely action towards their financial goals.

The essence of compound interest lies in its ability to foster substantial wealth growth with minimal ongoing effort. Understanding this financial principle is vital for anyone looking to achieve financial independence. With time as a formidable ally, the decisions individuals make today regarding their finances can lead to fruitful outcomes in the future.

Setting Financial Goals Early

Establishing clear and achievable financial goals at an early stage is a crucial step towards achieving financial independence. By identifying specific objectives, individuals can create a structured framework that facilitates informed decision-making regarding their finance. Short-term goals, such as saving for a vacation or purchasing a gadget, can motivate individuals while also instilling a sense of financial discipline. Meanwhile, long-term goals, like saving for retirement or purchasing a home, provide a pathway for sustained financial growth. Together, these goals create a comprehensive strategy that enhances overall financial health.

A robust approach to setting financial goals involves the SMART criteria: Specific, Measurable, Achievable, Relevant, and Time-bound. For instance, instead of stating a vague goal such as “I want to save money,” one could articulate a more precise objective, such as “I aim to save $5,000 for a down payment on a car within two years.” This level of specificity not only clarifies the goal but also allows for tracking progress over time, making adjustments based on financial situations more manageable.

In order to effectively manage finances and avoid overspending, it is paramount to develop a budget aligned with these goals. By allocating funds towards savings and investments, individuals build the discipline necessary for achieving their targets. This proactive stance fosters a sense of control over one’s financial future and encourages consistent review and adjustment of goals as situations evolve. Through this process, individuals not only instill positive spending and saving habits but also position themselves better to seize future financial opportunities.

Ultimately, the earlier one begins to set and work towards financial goals, the greater the potential to achieve financial independence over time. By creating a clear vision for both the short and long term, individuals can take charge of their economic futures, ensuring they make informed and purposeful financial choices.

Building Healthy Financial Habits

Developing healthy financial habits early in life is crucial for attaining long-term financial independence. One of the primary strategies is effective budgeting. Establishing a budget involves tracking income and expenses meticulously. Individuals should categorize their spending, allowing them to identify unnecessary expenditures and areas for potential savings. A well-structured budget not only clarifies financial priorities but also fosters disciplined spending, creating a foundation for a stable financial future.

Another integral habit is committing to regular savings. Financial experts recommend the “pay yourself first” strategy, which entails setting aside a fixed percentage of income before addressing other expenses. This disciplined approach ensures that individuals build their savings gradually, thereby creating a safety net for unexpected expenses or emergencies. For many, automating savings can further simplify the process, enabling funds to be transferred directly into a savings account without requiring active intervention.

Avoiding high-interest debt is equally important in building healthy financial habits. Credit cards and loans can lead to a cycle of debt if not managed carefully. It is crucial for individuals to understand the implications of high interest rates and to limit borrowing to avoid accumulating burdensome debt. Instead, focusing on making timely payments and paying off any outstanding balances effectively can help maintain a solid credit score.

Incorporating these practices into daily life empowers individuals to take control of their financial health. Engaging in regular financial evaluations can also enhance awareness regarding one’s financial standing. By cultivating budgeting skills, committing to savings, and avoiding excessive debt, individuals lay the groundwork for financial security. These habits not only bolster immediate financial stability but also contribute to a more independent and prosperous future.

Investing Early: What You Need to Know

Investing is a fundamental step towards achieving financial independence, and starting early can significantly enhance the potential for wealth accumulation. There are various investment vehicles available for beginners, each offering different risk and return profiles. Common options include stocks, bonds, real estate, and retirement accounts, such as 401(k)s and IRAs.

Stocks represent ownership in a company and can offer high returns, albeit with higher volatility. For those looking for stability, bonds—loans made to corporations or governments—generally provide lower returns but come with reduced risk. Real estate is another popular option, as property can appreciate over time, providing not only capital appreciation but also rental income. Retirement accounts serve as long-term savings tools, offering tax advantages that can accelerate growth.

Understanding one’s risk tolerance is crucial when embarking on an investment journey. Risk tolerance varies by individual and can be influenced by factors such as age, income, financial goals, and personal preferences. A higher risk tolerance may lead to a greater allocation in stocks, while a more conservative approach might lean towards bonds and fixed-income investments.

Diversification is also an essential component of a robust investment strategy. By spreading investments across different asset classes and sectors, individuals can mitigate potential losses and reduce overall portfolio risk. Early investors can benefit from this strategy as it helps to smooth out market fluctuations over time.

Enrolling in investment plans as early as possible offers several advantages. Compounding interest, where earnings generate additional earnings, works best over longer time horizons. Starting early can yield significant benefits, making timely investment decisions a critical factor for those aspiring to achieve financial independence.

Overcoming Common Barriers to Early Investment

Embarking on the journey of early investment can often be daunting, with many individuals facing an array of fears and misconceptions that hinder their financial progress. One prevalent barrier is the fear of losing money, which can often stem from a lack of understanding about how investments work. This apprehension is entirely normal; however, recognizing that all investments carry some degree of risk is essential. It’s critical for potential investors to educate themselves about various financial instruments and the market dynamics to alleviate these fears and make informed decisions.

Another common misconception is the belief that substantial wealth is a prerequisite for investing. Many think they need to accumulate significant capital before they can start; however, this is not the case. In reality, starting with smaller investments can help individuals gradually learn the ropes of investing without risking their financial security. Additionally, utilizing platforms that allow fractional share purchasing can facilitate entry into the investment realm at a comfortable pace.

Lack of knowledge about investment strategies and the financial market can be a considerable deterrent. Therefore, focusing on education is paramount. Resources such as online courses, webinars, and podcasts can provide invaluable information for those looking to understand the basics of investments. Seeking mentorship from experienced investors can also help demystify the process and provide personalized guidance. Mentorship can be a powerful motivational tool, facilitating discussions that encourage individuals to take that initial plunge into investing.

Moreover, developing a step-by-step plan can empower individuals to overcome the emotional hurdles associated with investing. Setting aside a specific amount each month for investment, regardless of how small, helps build consistency and confidence. Each positive experience can reinforce the habit of investing, ultimately leading to greater financial independence over time.

The Role of Financial Education

Financial education plays a pivotal role in achieving financial independence, as it equips individuals with the knowledge and skills necessary to navigate the complexities of personal finance. In an era where financial decisions can significantly impact one’s future, understanding key concepts such as budgeting, investing, and saving is more important than ever. Financial literacy empowers individuals to make informed choices, avoid pitfalls, and ultimately take control of their financial destinies.

There are numerous resources available for self-education in financial matters. Books, online courses, podcasts, and websites dedicated to personal finance provide a wealth of information that anyone can access. These resources cater to various learning styles, whether one prefers reading, listening, or interactive learning. Utilizing credible sources can help demystify the often-confusing world of finance, making it easier for individuals to grasp essential concepts and strategies. This foundational knowledge is vital as it allows individuals to assess their financial situations accurately and set realistic financial goals.

Moreover, financial workshops and seminars can offer invaluable hands-on experience. These events not only provide expert insights but also allow participants to ask questions and engage with other learners. Workshops often cover specific topics, such as retirement planning, investment strategies, and debt management, thereby addressing the diverse needs of individuals at different life stages. Networking opportunities within these environments can also foster connections with like-minded peers who share a common goal of financial independence.

Ultimately, the confidence that comes from financial education cannot be overstated. Armed with knowledge, individuals are better equipped to make timely decisions regarding investments, savings, and spending. This proactive approach to finances can set the stage for long-term financial health and independence, making financial education a crucial component in one’s journey toward becoming financially savvy and self-sufficient.

Real-Life Success Stories

The journey to financial independence often seems daunting, yet many individuals have successfully navigated this path through timely action and strategic planning. Their stories serve as a source of inspiration and insight for those seeking to achieve similar financial goals. One noteworthy example is that of John, a software engineer, who began investing in his 401(k) as soon as he entered the workforce at age 22. By diligently contributing a portion of his salary and taking advantage of employer matching contributions, John experienced compound interest’s benefits over the years. At the age of 40, he had amassed a sizable retirement fund, enabling him to transition into a consulting role, thus allowing him more time to pursue personal interests.

Similarly, Sarah, a graphic designer, capitalized on the potential of the stock market by starting to invest at a young age. Rather than waiting for a more stable financial situation, she adopted a frugal lifestyle to save and invest a consistent percentage of her income. Over time, Sarah not only built a diverse portfolio but also educated herself on investment strategies. As a result, by the age of 35, she had reached her goal of financial independence, allowing her to leave her corporate job and establish her own design firm.

These success stories exemplify the impact of early financial decisions. They highlight how individuals can harness the power of time and disciplined saving to achieve greater financial outcomes. The stories of John and Sarah demonstrate that taking action early can lead to significant advantages, allowing them to pursue their passions and create a lifestyle aligned with their values. Both examples underscore the importance of making informed decisions and starting financial planning as soon as possible, reinforcing the idea that with perseverance and knowledge, financial independence is attainable.

Conclusion

Achieving financial independence is a goal that many aspire to, yet it often remains elusive for numerous individuals. Through diligent planning and timely action, the importance of starting early in one’s financial journey cannot be overstated. This blog post has highlighted how the early bird advantage enables individuals to capitalize on the benefits of compounding interest, savings, and investment opportunities. By taking proactive steps, even individuals at the beginning of their financial journey can lay the groundwork for a secure financial future.

Financial literacy plays a critical role in this process. By understanding key financial concepts and strategies, individuals can make informed decisions that align with their long-term goals. Engaging with trustworthy resources, attending workshops, or seeking guidance from financial advisors can significantly enhance one’s awareness and skills. Emphasizing the importance of setting achievable goals, developing a budget, and monitoring expenses are essential components that should be integrated into one’s financial strategy.

Regardless of where you currently stand on your financial journey, it is never too late to start taking action. The path to financial independence begins with the first step, whether that involves opening a savings account, starting to invest, or simply educating oneself about personal finance. The choices made today will impact tomorrow’s financial landscape, making it imperative to prioritize financial well-being.

In light of these points, readers are encouraged to reflect on their current financial situation and identify actionable steps they can take towards achieving greater financial literacy. Embrace the journey towards financial independence. Your future self will thank you for the timely actions you take today.