What is a Credit Score?

A credit score is a numerical representation of an individual’s creditworthiness, assessing their likelihood of repaying borrowed funds. It is primarily used by lenders to evaluate the risk associated with loaning money to potential borrowers. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Generally, a score above 700 is considered good, while scores below 600 may be viewed as poor, potentially limiting access to favorable lending terms.

Several factors contribute to the determination of a credit score. The most influential factors include payment history, which constitutes approximately 35% of the score, and credit utilization, accounting for about 30%. Payment history reflects an individual’s track record in managing payments on credit cards, loans, and mortgages. It is essential for individuals to make on-time payments to maintain a positive score. Credit utilization, on the other hand, refers to the ratio of current credit card balances to total available credit and is an essential factor that lenders consider. Maintaining low balances relative to credit limits is recommended for a healthy score.

Other contributing elements include the length of credit history (15%), types of credit accounts (10%), and recent inquiries into credit (10%). A long and varied credit history can positively influence a credit score, as it demonstrates experience in managing different types of credit. Additionally, when applying for new credit, lenders may conduct inquiries that can temporarily impact the score. Understanding these various factors is crucial, as credit scores play a significant role in determining loan eligibility, interest rates for mortgages and credit cards, and insurance premiums.

The Importance of Good Credit

Maintaining a good credit score is crucial for navigating today’s financial landscape effectively. A credit score serves as a representation of an individual’s creditworthiness, influencing various aspects of financial life. One of the most visible impacts of a poor credit score is the difficulty in obtaining loan approvals. Lenders use credit scores to assess the risk of lending money; a low score can lead to application denials or reduced credit limits. In contrast, those with good credit scores generally find it significantly easier to secure loans and credit lines.

Additionally, good credit often translates into lower interest rates on loans and credit cards. Lenders reward borrowers with higher credit scores by offering them more favorable terms. For instance, a person with a score in the excellent range may receive a mortgage interest rate that is substantially lower than that of someone with a poor score. These savings can amount to thousands of dollars over the life of a loan, underscoring the long-term financial advantages of maintaining a strong credit profile.

Beyond loans and interest rates, credit scores can also impact insurance premiums. Some insurance companies will review credit histories when determining premiums for auto or home insurance. Individuals with lower credit scores may face higher premiums, which reflect the perceived risk the insurer associates with their financial behavior. Furthermore, a good credit score can even influence employment opportunities. Some employers conduct credit checks during the hiring process, particularly for positions that require financial responsibilities. A strong credit history signals reliability and responsibility, qualities that are desirable among employers.

In summary, the importance of maintaining a good credit score cannot be overstated. From loan approvals to interest rates, insurance premiums, and job prospects, the effects of credit scores permeate various facets of financial and professional life, ultimately shaping an individual’s future financial security.

How Credit Scores Are Calculated

Credit scores are essential metrics that help lenders assess an individual’s creditworthiness. These scores are typically calculated using five major factors that collectively influence the overall credit rating. Understanding how these components are weighted can empower consumers to make informed financial decisions and enhance their credit profiles.

The first factor is payment history, which accounts for approximately 35% of a consumer’s credit score. This factor reflects whether an individual has made their payments on time. Late payments, defaults, and bankruptcies can significantly damage one’s score, making timely payments crucial for maintaining a positive rating.

Next is credit utilization, which comprises about 30% of the overall score. This ratio compares an individual’s current debt to their total available credit. Ideally, it is advisable to keep credit utilization below 30%, as maintaining low balances on credit cards indicates responsible borrowing behavior.

The length of credit history, contributing around 15% to the score, is determined by the age of the oldest account, the average age of all accounts, and the length of time since recent account openings. A longer credit history generally implies a more reliable borrowing pattern, providing lenders with insights into an individual’s credit behavior over time.

Furthermore, the types of credit in use account for about 10%. Credit can come in various forms, such as revolving credit (like credit cards) and installment loans (like mortgages and auto loans). A diverse mix of credit types can bolster a credit score, indicating that the consumer can manage different types of debt effectively.

Lastly, new credit inquiries, which have a 10% influence on credit scores, occur when lenders check a consumer’s credit report for loan applications. Multiple inquiries in a short period can negatively impact the score. Consequently, being mindful about applying for new credit can help protect an individual’s credit reputation.

Common Myths About Credit Scores

Credit scores are often shrouded in misunderstandings and myths, which can lead to detrimental financial decisions. One prevalent myth is that checking your own credit score will negatively impact it. In reality, when you check your own credit, it is termed a “soft inquiry,” which does not affect your score. However, a “hard inquiry” occurs when a lender checks your credit for decision-making purposes, and multiple hard inquiries in a short time can slightly lower your score.

Another common misconception is that having no credit history is better than having a bad one. While a negative credit report can certainly be less desirable, having no credit history at all can also be problematic. Lenders rely on credit scores to assess risk; therefore, a lack of credit activity could make it difficult for individuals to secure loans or credit lines. Establishing a credit history through responsible use of credit cards or small loans can ultimately help improve a credit score.

Additionally, there is a belief that closing old accounts will improve a credit score. In fact, this can have the opposite effect. Length of credit history is a factor in calculating credit scores, and closing an old account can reduce the average age of accounts, which might lower the score. Maintaining older credit accounts, even if they are not being actively used, can positively impact credit ratings.

Lastly, some individuals think that paying off a collection account will completely erase its negative effect. While settling a collection can help improve your score over time, the mark may remain on your credit report for up to seven years. It is essential to understand how various factors influence credit scores to make informed decisions that can genuinely enhance one’s financial standing.

Steps to Improve Your Credit Score

Improving your credit score is essential for achieving financial stability and obtaining favorable loan terms. Here are several actionable steps that can be taken to enhance your credit score effectively.

1. **Regularly Review Your Credit Report**: Start by obtaining a copy of your credit report from the major credit bureaus. Check for any inaccuracies or outdated information that may negatively impact your score. If you find errors, dispute them immediately to ensure your report reflects your true credit history.

2. **Timely Payments**: Your payment history significantly influences your credit score. Establish a routine of paying bills, such as loans, credit cards, and utilities, on or before their due dates. Setting reminders or utilizing automated payment systems can help maintain consistency.

3. **Reduce Outstanding Debt**: High levels of debt can lower your credit score. Aim to reduce credit card balances and other debts. Prioritizing payments based on interest rates can help you save money while improving your credit utilization ratio, which is a key factor in your overall credit assessment.

4. **Limit New Credit Applications**: When you apply for new credit, a hard inquiry is generated, which can temporarily reduce your score. Limit the number of credit applications you submit and only apply when necessary. Spacing out applications can help mitigate any potential negative impact on your score.

5. **Diversify Credit Types**: Having a mix of credit types, such as installment loans and revolving credit, can enhance your credit score. If you only have credit cards, consider adding a small personal loan or an auto loan to create a diverse credit profile.

6. **Keep Old Accounts Open**: The length of your credit history also factors into your score. Keep older credit accounts open, even if they are not in regular use, to strengthen your credit history over time.

By implementing these strategies consistently, individuals can progressively elevate their credit scores and pave the way for a better financial future.

How to Monitor Your Credit Score

Monitoring your credit score is an essential component of maintaining financial health and making informed decisions about your finances. There are several methods available that allow individuals to keep track of their credit scores effectively. One of the most established methods is through credit reporting services. These services provide regular updates on your credit score and detailed reports outlining your credit history, payment habits, and any outstanding debts.

Many people choose to utilize the services of three major credit bureaus—Equifax, Experian, and TransUnion. Each bureau calculates credit scores slightly differently, so it is wise to monitor reports from all three to get a comprehensive view of your credit standing. Through these bureaus, individuals can request a free credit report once a year, helping them to identify any inaccuracies or fraud that could negatively impact their score.

In addition to traditional credit reporting services, numerous financial apps offer tools for tracking your credit score. Many of these applications are free and provide users with real-time updates on their credit standing. These apps often feature personalized insights and alerts to inform users of significant changes, thus enabling proactive measures to improve or protect their credit scores. Furthermore, they can help track your spending habits, which is also vital for maintaining a healthy credit history.

It is important to be aware of your legal rights concerning credit score monitoring. Under the Fair Credit Reporting Act (FCRA), consumers are entitled to access their credit reports annually without charge. This level of transparency promotes financial literacy and helps individuals make informed decisions regarding loans, mortgages, and other credit-related activities. Regular monitoring of your credit score can empower you to manage your financial future effectively.

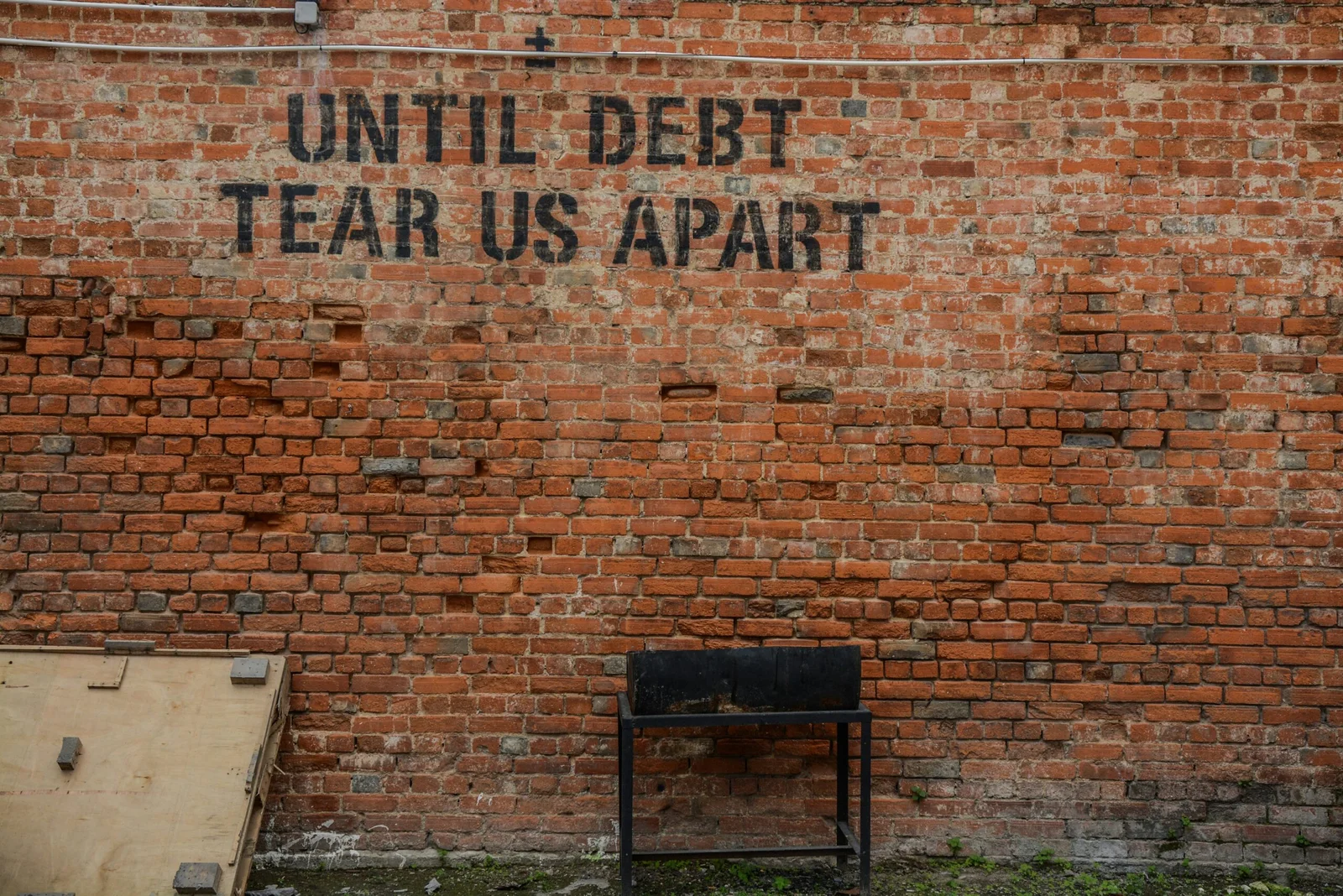

The Impact of Debt on Your Credit Score

Your credit score is a crucial element in determining your financial health, and it is heavily influenced by the amount and type of debt you carry. Essentially, credit scores evaluate how responsibly you manage borrowed money, which includes both revolving debt, such as credit cards, and installment debt, like personal loans or mortgages. Understanding the distinction between these two types of debt is important when aiming to improve your credit score.

Revolving debt, characterized by credit cards, tends to have a more immediate impact on your credit score. This is primarily due to the credit utilization ratio, which measures how much of your available credit is being used. A higher utilization ratio can signal to lenders that you are over-reliant on credit, potentially leading to a lower score. Ideally, maintaining a utilization ratio below 30% is recommended to positively influence your credit dynamics.

On the other hand, installment debt typically has a less frequent but significant impact on credit scores. Repayment history is critical here; consistent, on-time payments can help enhance your creditworthiness over time. However, defaulting on installment loans can severely damage your score, making it essential to manage these debts diligently. It is advisable to prioritize paying down high-interest installment loans and to consolidate debts where possible to streamline payments and potentially lower interest rates.

Moreover, navigating your debts effectively involves not only maintaining timely payments but also being aware of how new credit applications can affect your score. Each application for new credit can initiate a hard inquiry that may momentarily reduce your score. By strategically managing both revolving and installment debts, you can work towards a healthier credit profile that will serve you well in the long run.

Recovering from Poor Credit

Recovering from a poor credit score can be a daunting journey, but with patience and dedication, improvement is attainable. The first step towards recovery is to assess your current credit situation. This involves requesting a free credit report from the major reporting agencies. Upon reviewing your report, identify any inaccuracies or outdated information that may be negatively impacting your score. Disputing these errors can lead to significant improvement in your credit rating.

Negotiating with creditors is another powerful strategy for those with low credit scores. If you have outstanding debts, consider reaching out to your creditors to discuss possible repayment plans or settlement options. Many lenders are willing to work with you to create manageable payment structures, especially if you demonstrate a willingness to rectify the situation. Regularly paying agreed amounts can show positive financial behavior that credit agencies take into account.

Another effective method to improve your credit is by becoming an authorized user on a responsible individual’s credit card. This approach allows you to benefit from their positive credit history without being entirely responsible for the account. If the primary cardholder maintains a low balance and makes timely payments, it can enhance your own credit score over time.

Furthermore, establishing a budget that prioritizes essential expenditures and allows for regular contributions to any existing debts you have will help in long-term recovery. Additionally, consider opening a secured credit card, which can provide a pathway to rebuild credit as long as payments are made on time. Gradually, as your credit utilization ratio improves and payments are consistently made, you will start to see your credit score ascend.

Above all, staying informed and educated about credit scores will empower you in your recovery efforts. By implementing these strategies patiently and persistently, a brighter financial future is well within reach.

The Future of Credit Scores

As we look towards a rapidly evolving financial landscape, the future of credit scores is becoming increasingly important. Traditional credit scoring models, primarily dependent on credit history, are now being supplemented and, in some cases, challenged by emerging trends. One notable shift is the incorporation of alternative data sources. These sources can include non-traditional metrics such as utility payments, rental history, and even education levels, providing a more holistic view of an individual’s creditworthiness. Such advancements aim to offer a fairer assessment for those who may lack a comprehensive credit history.

Additionally, advancements in technology are reshaping how lenders evaluate potential borrowers. Machine learning algorithms and artificial intelligence (AI) are now being utilized to process vast amounts of data more efficiently than ever before. These technologies not only improve the accuracy of credit risk assessments but also reduce the likelihood of bias that can exist in human decision-making. As lenders increasingly adopt these sophisticated tools, consumers may experience varying credit assessments, highlighting the need to remain informed and adaptable.

Regulation is another crucial factor that may influence the future of credit scoring. As policymakers become aware of the potential drawbacks of existing credit evaluation methods, there could be a push for more transparent and equitable practices. Regulations aimed at protecting consumers from discriminatory lending practices may emerge, fostering a more inclusive financial environment. These changes might lead to the development of entirely new credit score models designed to benefit a more diverse population.

In conclusion, understanding the future of credit scores is essential for consumers navigating their financial journeys. By staying abreast of emerging trends, including alternative data usage, technological advancements, and potential regulatory shifts, individuals can better prepare themselves to improve their creditworthiness in an evolving financial landscape.