Introduction to Debt Repayment Strategies

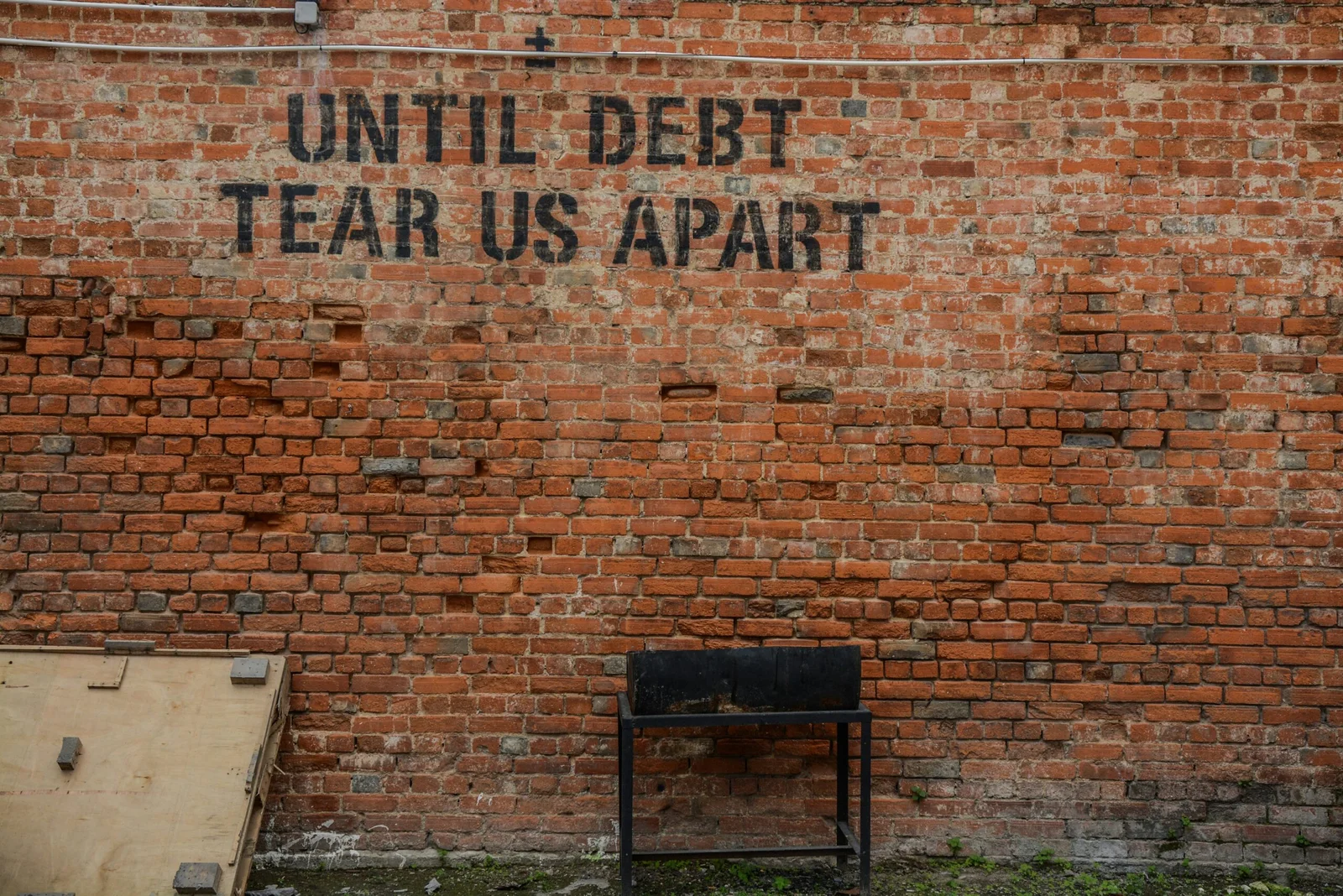

Effective debt repayment is a crucial aspect of personal finance management. In today’s world, many individuals find themselves grappling with various forms of debt, whether from credit cards, student loans, or other financial obligations. This accumulation of debt can lead to significant stress and anxiety, making it imperative to adopt a structured strategy for repayment. The right approach not only assists individuals in regaining financial stability but also contributes positively to their mental well-being.

Understanding the significance of effective debt repayment methods is essential. High levels of debt can hinder one’s ability to save for emergencies or invest in future goals. Moreover, carrying unresolved debt often results in increased financial strain, which may lead to detrimental effects on mental health, including feelings of inadequacy or hopelessness. Thus, having a clear plan in place to tackle debt is not just a financial necessity, but a step towards restoring peace of mind.

Two prominent strategies that individuals often consider for paying off their debts are the snowball method and the avalanche method. The snowball method focuses on paying off smaller debts first, providing early wins that can bolster motivation. In contrast, the avalanche method targets debts with the highest interest rates, aiming to minimize the total interest paid over time. Each of these methods carries its own unique benefits and challenges, and understanding them is crucial for effective debt management.

As we explore the details of these two methodologies, it is vital to recognize that the choice of a debt repayment strategy should align with individual financial situations and psychological preferences. Making an informed decision regarding debt repayment can pave the way towards financial freedom and enhanced emotional health.

Understanding the Snowball Method

The snowball method is a popular approach to debt repayment that focuses on the psychological benefits of achieving quick wins. This method entails prioritizing the repayment of the smallest debts first while maintaining minimum payments on larger debts. By eliminating smaller debts rapidly, individuals can experience a sense of accomplishment that often energizes their overall debt repayment journey.

To employ the snowball method, debtors first compile a list of their debts, organized from the smallest to the largest. The first step is to concentrate financial resources on the smallest debt by making additional payments towards it, while making the required minimum payments on other debts. Once the smallest debt is satisfied, the individual then moves on to the next smallest debt, applying the same principle. This creates a cycle where the amount allocated for debt repayment snowballs from one paid-off debt to the next larger one. Each time a debt is paid off, the individual gains momentum and motivation to tackle larger debts.

One of the most compelling advantages of the snowball method is the emotional boost it offers. As debts are paid off, individuals often report feelings of relief and accomplishment, which can encourage them to remain committed to their overall financial goals. This method caters to the human desire for progress; it instills a sense of hope and fosters a positive mindset, making it particularly appealing to those struggling with motivation. Additionally, the structure of the snowball method allows for a manageable and less overwhelming pathway to debt freedom, ultimately empowering individuals to take control of their finances.

Understanding the Avalanche Method

The Avalanche Method is a debt repayment strategy that focuses on paying off debts with the highest interest rates first. This approach is grounded in the principle that by reducing high-interest debt more quickly, individuals can save money on interest payments over time, leading to a more efficient overall debt repayment process. While this method may not provide the immediate gratification of seeing smaller debts disappear quickly—as is the case with the Snowball Method—it is mathematically advantageous for those looking to minimize their financial costs.

When employing the Avalanche Method, it is essential to list all debts by their respective interest rates, starting with the loan or credit card with the highest rate. For instance, if an individual has three debts, one with a 20% interest rate, another at 15%, and the last at 10%, the effective strategy would be to direct any extra payments toward the 20% debt while making minimum payments on the others. This prioritization helps reduce the total amount of interest paid over time, allowing for a more rapid descent into financial freedom.

Calculating the financial impact of the Avalanche Method can illustrate its advantages. By paying down high-interest debts first, borrowers typically save more money compared to other repayment strategies. The overall savings can be substantial, depending on the total amount of debt and the time it takes to pay it off. Although it may initially appear that progress is slow, as lower-balance debts may take longer to tackle, the critical savings in interest ultimately lead to faster repayment times and reduced overall financial burden.

The Avalanche Method, therefore, stands out as a strategic choice for those who are motivated by long-term savings rather than short-term victories. By understanding the benefits and the practical implications of this method, individuals can make informed choices about their debt repayment strategies that align with their financial goals.

Comparative Analysis: Snowball vs Avalanche

The snowball and avalanche methods represent two distinct approaches to debt repayment, each with its own advantages and disadvantages. By examining these strategies closely, individuals can make informed decisions on which method may best align with their financial goals and emotional preferences.

The snowball method prioritizes paying off the smallest debts first. This approach can provide a psychological boost; as individuals eliminate debts, they experience a sense of achievement. The emotional impact of seeing debts disappear can be motivating, fostering a commitment to the entire repayment process. However, this method may not always be the most financially efficient, as larger debts with higher interest rates remain unpaid until smaller debts are settled.

Conversely, the avalanche method focuses on repaying debts with the highest interest rates first. This approach is typically more cost-effective as it reduces the overall interest paid over time. Although it can require more patience and discipline, it is strategically advantageous for those who prioritize minimizing total repayment costs. The downside for some may be the initial slower progress in eliminating debt, which can lead to frustration.

When considering the speed of repayment, the avalanche method may generally lead to faster total debt reduction due to its focus on high-interest balances. However, for individuals who thrive on motivation and positive reinforcement, the snowball method’s quick wins might serve better in maintaining momentum.

Ultimately, the decision between the snowball and avalanche methods must entail a balance of emotional satisfaction and financial rationality. Individuals should assess their debt profiles, emotional responses, and overall financial objectives to determine which method is more suitable for their unique circumstances.

Assessing Your Financial Situation

Before determining the most effective method to pay off debt, it is essential to conduct a thorough assessment of your financial situation. This comprehensive evaluation will serve as the foundation for making informed decisions regarding debt repayment strategies. Start by gathering all relevant information about your total debt. Create a detailed list that includes the amounts owed on each account, the interest rates associated with them, and any minimum monthly payments required.

Next, examine your payment history to identify patterns and behaviors that may have contributed to current debt levels. A consistent record of late payments, for instance, can not only impact your credit score but also add to the total amount owed due to accruing interest and potential penalties. Understanding your past behaviors will help you strategically plan future payments, regardless of whether you choose the snowball or avalanche method.

Your monthly budget plays a critical role in assessing your financial situation. Review your income sources and outgoing expenses to determine how much money can be allocated toward debt repayment each month. It is crucial to create a realistic monthly budget that balances necessary living expenses with a dedicated portion for debt reduction. This approach ensures your repayment plan aligns with your financial capabilities, minimizing the risk of falling back into debt.

Additionally, consider any changes in your financial situation that may have occurred recently, such as a change in employment, unexpected expenses, or additional income sources. These factors can significantly influence your ability to repay debt effectively. By evaluating your current financial health in detail, you will be better equipped to choose between the snowball method, which focuses on paying off smaller debts first, or the avalanche method, which prioritizes higher-interest debt. Such a comprehensive assessment is critical in ensuring that your debt repayment journey is not only efficient but also sustainable.

Creating a Personalized Debt Repayment Plan

When it comes to paying off debt, developing a personalized repayment plan is crucial for achieving financial stability. Both the snowball and avalanche methods offer distinct strategies that can cater to an individual’s unique financial situation. To get started, it is important to assess your debts, listing them from smallest to largest balance in the case of the snowball method, or from highest to lowest interest rate if you opt for the avalanche approach. This groundwork provides a clear overview of what you are up against and helps establish a focused plan of action.

Budgeting plays a pivotal role in any debt repayment plan. Begin by tracking your monthly income and expenses to identify areas where you can cut back. Allocating extra funds towards your debt will accelerate the repayment process. Consider setting a specific amount each month dedicated solely to debt repayment. This method ensures that you remain committed to reducing your financial obligations progressively. Additionally, aim to set achievable short-term and long-term financial goals. Break down larger goals into manageable milestones, such as paying off one account or reducing total debt by a certain percentage.

Tracking progress is an integral component of maintaining motivation. Regularly review your debt balances and the progress you’ve made. Keeping a visual representation, such as a chart or spreadsheet, can clearly illustrate your journey, helping you stay focused. This simple act of tracking can bolster your resolve, making the end result feel more attainable. Remember to celebrate small victories along the way, such as paying off an account, to keep morale high. Ultimately, creating a personalized debt repayment plan tailored to your situation will empower you on your journey towards financial freedom.

Overcoming Challenges in Debt Repayment

Embarking on the journey to become debt-free often comes with a multitude of obstacles that can hinder progress. One of the most common challenges faced by individuals is unexpected expenses. These can arise from car repairs, medical bills, or instances of job loss. It is crucial to establish an emergency fund to mitigate the impact of these unforeseen costs. A small financial cushion can provide peace of mind and prevent the need to incur additional debt when unexpected bills surface.

Another significant hurdle is the temptation to overspend. In an environment where consumerism is prevalent, sticking to a budget can be particularly challenging. To combat this, it is advisable to create a detailed budget that highlights expenditures and categorizes discretionary spending. Utilizing budgeting apps or financial planners can enhance this process, fostering discipline and accountability. Furthermore, it may be beneficial to limit exposure to potential triggers, such as social pressures to dine out or shop excessively.

Emotional setbacks can also threaten momentum in debt repayment. The stress associated with financial struggles may lead to feelings of defeat, potentially resulting in a cycle of procrastination. Recognizing these emotional challenges is essential for maintaining focus on the goal of debt freedom. Engaging in positive affirmations, setting smaller, achievable milestones, and celebrating progress can help bolster motivation. Additionally, seeking support from friends, family, or financial counselors can provide encouragement and accountability, making it easier to navigate hard times.

Persistence and resilience are key components in overcoming the challenges of debt repayment. By acknowledging potential obstacles and proactively strategizing to manage them, individuals can better maintain their trajectory towards financial independence. The journey may be fraught with difficulties, but with determination and the right approach, it is possible to overcome these challenges effectively.

Real-Life Success Stories

Debt can often feel overwhelming; however, many individuals have turned their financial situations around by employing systematic strategies like the snowball and avalanche methods. These success stories provide insight into the real-world application of these techniques and the transformative power they can hold.

One notable example is Sarah, a 34-year-old teacher from Colorado, who found herself $50,000 in debt, including student loans and credit card balances. After facing the stress of managing multiple payments each month, she chose the snowball method to tackle her debts. Sarah began by targeting her smallest debt, a credit card balance of $500. Once she paid that off, she applied the same payment amount towards her next smallest debt, gradually gaining momentum. Within two years, she had eliminated all her debts. Sarah credits her success not only to the structured plan but also to the motivation she felt as each debt was paid off, leading her to a debt-free life.

Conversely, John, a 45-year-old software engineer from Texas, opted for the avalanche method when he found himself in debt totaling $30,000. With a keen interest in saving on interest payments, John targeted his highest interest debts first, mainly comprising credit cards with rates exceeding 20%. He meticulously analyzed his finances, redirected savings into aggressive payments, and managed to pay off his debts in just 18 months. John reflects on his experience as a game-changer, emphasizing how the carefully structured avalanche method not only cleared his debt but also saved him thousands in interest payments.

These stories highlight the varied paths individuals can take towards financial freedom. By choosing a suitable repayment strategy, both Sarah and John demonstrate how disciplined efforts, combined with a tailored approach, can lead to successful debt elimination.

Conclusion: Choosing the Right Method for You

As individuals navigate the journey of debt repayment, understanding the differences between the snowball and avalanche methods can be instrumental in making a decision that aligns with their financial goals and personal values. The snowball method focuses on psychological benefits, prioritizing smaller debts and providing a series of quick victories that can boost motivation. Conversely, the avalanche method emphasizes cost-effectiveness, targeting high-interest debts first to minimize the total interest paid over time.

Ultimately, the choice between these two popular debt repayment strategies should not be taken lightly. It is essential for each person to assess their unique financial situation and emotional resilience. For someone who thrives on immediate gratification, the snowball approach may be more appealing, as it can create a sense of accomplishment that fuels further progress. On the other hand, for those who prioritize long-term savings and have the discipline to manage larger debts upfront, the avalanche method might be the more suitable choice.

Additionally, commitment and perseverance are critical components of any successful strategy for paying off debt. Regardless of the method chosen, maintaining a clear focus on one’s ultimate goal—freedom from debt—can help mitigate feelings of frustration that may arise during the repayment process. Establishing a budget, seeking support from financial professionals, or joining debt repayment communities could also enhance an individual’s journey toward financial stability.

In summary, choosing the right debt repayment method is a highly personal decision that should reflect individual circumstances and values. By carefully considering both strategies and maintaining a steadfast commitment to the chosen approach, individuals can pave their way toward a debt-free future, fostering both financial health and peace of mind.